“The European Central Bank (ECB) has surprised the markets by cutting its benchmark refinancing rate by 0.25% to 0.25% today. It also reduced the marginal lending rate to 0.75% and kept the deposit rate at zero. The move comes in the wake of lower than expected inflation data from the Euro Area last week (Euro Area inflation was just 0.7% in September) and October purchasing manager data showing that European economic activity is running well below the US and UK.

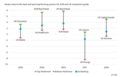

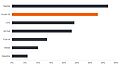

“We have argued that the ECB’s monetary stance was too tight, with unemployment at a record high 12.2% and inflation significantly undershooting the target. The rate cut is a strong signal that the ECB is willing to ease policy further and there has already been a marked reaction with bond yields in core and periphery markets lower, equities up and the euro falling in value relative to other major currencies. While the refinancing rate cut is largely symbolic the reaction of other markets helps the macro outlook in that it provides an easing of financial conditions across the Euro Area (Spanish and Italian 5-year yields down by 15bp today on the back of the rate cut). So this is good news for fixed income assets as the ECB is still clearly in easing mode and therefore will be committed to a lower for longer interest rate policy. The ECB also said that it expects rates to remain at current or lower levels for an extended period of time, based on the view that the central bank expects inflation to remain low for some time, implying that rates could be reduced again. This should mean lower yields across the core and peripheral curves and some flattening of yield curves. It is good news for credit as it locks in lower financing costs for Euro borrowers when credit fundamentals are already favourable. The same is true for European High Yield as investors seek higher returns and supports European equity markets, particularly if we do see continued improvements in the activity data.

“The move is consistent with our overweight European fixed income asset allocation stance in rates, credit and high yield and puts clear water between the ECB and the Federal Reserve (Fed) regarding the path of interest rates over the next few months. The Fed may want to delay tapering but there is little chance of the Fed introducing additional accommodation (GDP grew by 2.8% in Q3) while the ECB can and probably will ease further. As such the likely decline in the euro’s exchange rate will be very good news for European exporters. We also continue to have an overweight position in peripheral debt with Spanish and Italian 10-yr yields likely to move significantly below 4.0% in the short term in our opinion.”

www.fixed-income.org